India, with its rapid economic growth and vast market potential, presents a compelling opportunity for foreign entities looking to expand their business. As one of the fastest-growing economies among emerging markets, India offers a unique blend of a large consumer base, a favourable tax structure, low operational costs, and robust trade networks. Let us explore the details of setting up an entity in India, covering the key considerations, regulatory requirements, and strategic insights necessary for a successful entry.

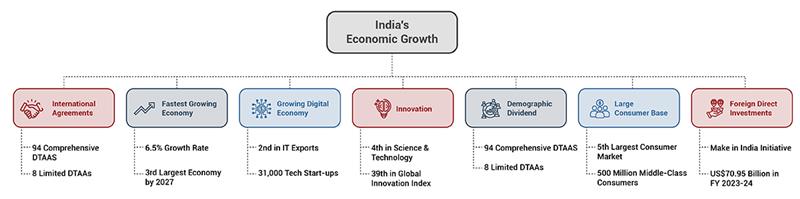

Why Invest in India?

India’s robust economic growth, large consumer market, and favourable government policies make it an attractive destination for global investors. The country’s strategic location, strong ties with major economies, and initiatives like “Make in India” further enhance its appeal.

Economic Overview

India is one of the largest and fastest-growing democracies in the world, with a projected GDP growth of 6.7% for 2025-26. The economy is expected to reach a valuation of approximately US$5.3 trillion by 2027. Currently, India is the 5th largest economy globally and the 3rd largest by purchasing power parity on a per capita basis. With a middle-class population exceeding 500 million, India has the 5th largest consumer market globally, projected to become the 3rd largest by 2027.

Demographic Advantages

India has the largest adolescent and youth population globally, with a median age of 28.2. Approximately 65% of the population is below 35, providing a significant demographic dividend. This young and dynamic workforce is a key economic growth and innovation driver.

Digital Economy

India ranks 2nd in global telecommunication, computer, and information services exports, with 954 million internet subscribers. The number of tech startups in India grew from 2,000 in 2014 to 31,000 in 2023. According to the Global Innovation Index (GII) 2024, India ranked 39 out of 133 countries, reflecting its growing digital economy and innovation ecosystem.

Government Incentives

The Indian government has introduced several initiatives to boost the economy and attract foreign investment. These include:

Production-Linked Incentive (PLI) Schemes

With an allocation of INR 1.97 trillion (approximately US$23.3 billion) for 14 production-linked sectors, the PLI program has attracted INR 12.50 trillion in investments and created 950,000 jobs. Exports have surpassed INR 4 trillion, driven by electronics, pharmaceuticals, and food processing sectors.

GIFT City

India’s first International Financial Services Centre (IFSC) in Gujarat aims to boost global financial services by providing financial incentives, regulatory freedom, and world-class infrastructure.

Semiconductor Ecosystem Development

“Semicon India” aims to reduce reliance on semiconductor imports with a significant investment of approximately INR 760 billion (US$8.99 billion).

Startup India

India is home to over 156,000 recognised startups, ranking 3rd globally in the number of startups. These startups benefit from favourable tax reforms and the abolition of the angel tax. Tax incentives include a 100% deduction on profits and gains for three consecutive years within their first decade of operation. Non-resident investments up to INR 100 million in startups are exempt from certain taxes.

Unified Payments Interface (UPI)

India leads in digital payments, processing nearly 46% of global real-time transactions. The total UPI transaction volume from January to November 2024 was INR 223 trillion.

Investment Opportunities

India offers a wide range of investment opportunities across various sectors. Foreign Direct Investment (FDI) inflows reached US$70.95 billion in FY 2023-24, with equity inflows amounting to US$44.42 billion. The “Make in India” initiative has attracted unprecedented FDI, making India a strategic choice for global investors.

Regulatory Framework

Foreign investment in India is allowed in almost all sectors, with the remaining sectors requiring approval. FDI can be made under two routes:

Government Route

Approval from the Government of India, the Ministry of Finance, and the Foreign Investment Promotion Board (FIPB) is required.

Automatic Route

No approval from the Government of India is required for the investment.

Prohibited Sectors

Investment is not allowed in specific sectors.

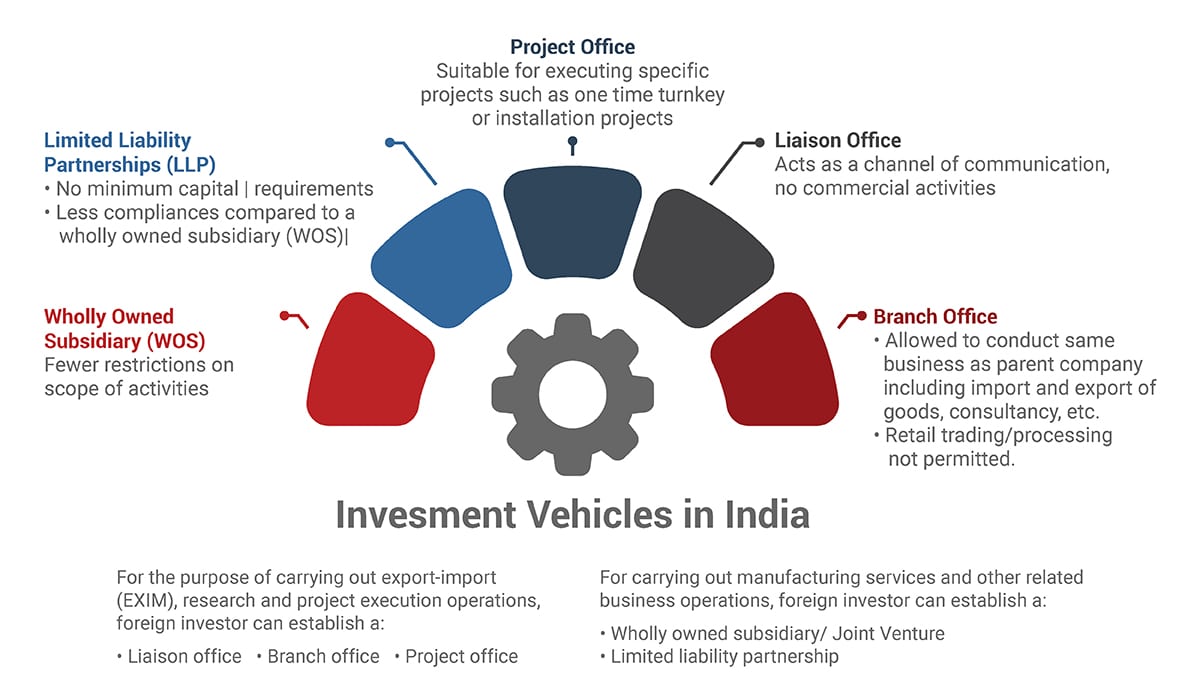

Establishing a Presence in India

Foreign companies must choose the entity structure that aligns with their business objectives to establish a strong presence in the Indian market. Options include unincorporated entities (Liaison Office, Branch Office, Project Office) and incorporated entities (Private Limited Companies, Limited Liability Partnerships, Joint Ventures).

Setting Up Unincorporated Entities – For Exploring the Markets in India

| Structure | India Liaison Office/ Representative Office | India Branch Office | India Project Office |

| Role/Purpose | A tool to explore market opportunities in India and promote the parent company’s business activities | Extension of a Parent Company engaged in the same activity as the parent | Established to manage large-scale projects like major construction, civil engineering, and infrastructure development |

| Eligibility/Prerequisite/Criteria for Setup | Applicant, a Foreign entity, should have:

Applicant, a Foreign entity, should have: • 3 Years of Profitable Track Record in Home Country • Net Worth > USD 50,000 or equivalent

|

Applicant, a Foreign entity, should have:

• 3 Years of Profitable Track Record in Home Country • Net Worth > USD 50,000 or equivalent. Applicant, a Foreign entity, should have: • 5 Years of Profitable Track Record in Home Country • Net Worth > USD 100,000 or equivalent

|

• FC should have secured a contract to execute a project in India from an Indian company and

|

| Time Frame for Incorporation | ~ 1.5 Months | ~ 2 Months | Registration: ~15 days. |

| Prohibited Business Activity | Not allowed to undertake any business activity in India. Only acts as a communication channel | Manufacturing and Processing Activities, Retail or Trading Activities in India | Activities other than those related to the specific project |

| Validity | ~Generally, for 3 years (Renewal of registration – Permissible) | No specific time frame, generally 2-3 years | As per the tenure of the project |

| Permissible Activities | 1. Representing Parent Company (PC) in India

2. Promoting export/import between India and the parent company 3. Facilitating technical/financial collaborations 4. Acting as a communication channel between the PC and Indian companies 5. Conducting market research

|

1. Export/Import of goods

2. Providing professional/consultancy services 3. Conducting research in PC field 4. Software development/IT services 5. Promoting technical collaborations 6. Acting as a buying/selling agent for PC (not retail trading) 7. Rendering back-office services

|

1. Executing a specific contracted project

2. Activities directly related to project execution 3. Procuring materials for the project 4. Hiring project-specific staff 5. Managing project finances |

| Revenue | Cannot earn any income in India. | Can earn only from activities allowed by the RBI. | – |

| Expenses to be met from | Inward remittances from the Parent Company | Inward remittances from the Parent Company or

Project-specific funding sources |

Inward remittances from the Parent Company |

| Tax Rate | Not subject to taxation as no commercial activity is allowed. | ~35% depending on income. (Budget 2024) | ~35% (Budget 2024) |

| Remittances back to HO | Not Applicable as they cannot earn any Income in India. |

Common Conditions

| Regulatory framework | The FEMA Regulations and Companies Act 2013 regulate the set-up operations and closure of LO/BO/POs. All three entities require RBI approval to be established. |

| Indian Representative | Parent Company must appoint an Indian Resident with a valid PAN as a local authorized representative (Mandatory Requirement) |

| Annual filing | File Annual Activity Certificates (AAC) from Chartered Accountants, at the end of March 31, along with the audited Balance Sheet on or before September 30 of that year |

| Net Worth | As per the latest Audited Balance Sheet or Account Statement certified by a Certified Public Accountant or any Registered Accounts Practitioner by whatever name |

| Entity Name | Must be the same as the Parent Company |

| Bank Account | All three forms of entities are required to maintain a Bank account in India |

| Liabilities | Parent Company’s liability is unlimited for all acts and omissions of LO/BO/PO |

Setting Up Incorporated Entities – For Expanding in India

| Structure | Limited Liability Partnership | Private Limited Company/Wholly Owned Subsidiary |

| Governed by | The Limited Liability Partnership Act 2008 | The Companies Act 2013 |

| Charter Documents | LLP Agreement | Memorandum of Association and Articles of Association |

| Permissible Activities | More suited for the Service sector | All types of business activities are permitted, such as in the Manufacturing/Marketing/Service sectors |

| Ownership and Management | Min 2 Designated Partners (DP)* | Min 2 Directors and Min 2 Shareholders* |

| Indian Representative (Mandatory Requirement) | Mandatory to have at least 1 DP who is an Indian Resident (i.e., residing in India for 121 days or more during the Financial Year) | Mandatory to have at least 1 Director who is an Indian Resident (i.e., residing in India for 183 days or more during the Financial Year) |

| Annual Compliances | • LLP is not mandatorily required to conduct Board meetings or AGM. | • 4 Board Meetings are mandatory in the Calendar year

|

| Foreign Investments (FDI) | Foreign investments are allowed only where 100% FDI is allowed by the automatic route | Foreign investments are allowed subject to FDI Policy |

| Funding | LLPs raise funds through contributions from Partners and loans from Banks and Financial Institutions | Companies can raise funds from angel investors and venture capitalists and also have an option for raising funds via debt |

| Winding up | Easy | Difficult |

| Punishment for Default | Mild to Moderate | High |

| Other Statutory Compliances | Medium | High |

| Taxation Rates | 30% | ~25 to 30%* |

| Entity Name | Must be unique and acceptable as per the Companies Act, 2013 or LLP Act, 2008.

|

– No minimum capital requirement.

|

| Validity | Perpetual Succession or will continue until its dissolution/as stated in the LLP Agreement | |

| Management* | Even a Body corporate can be a Shareholder/Designated Partner | |

| Time Frame for Incorporation | ~ 1 Month | |

| Staff hiring | Can Hire Local and Foreign Staff |

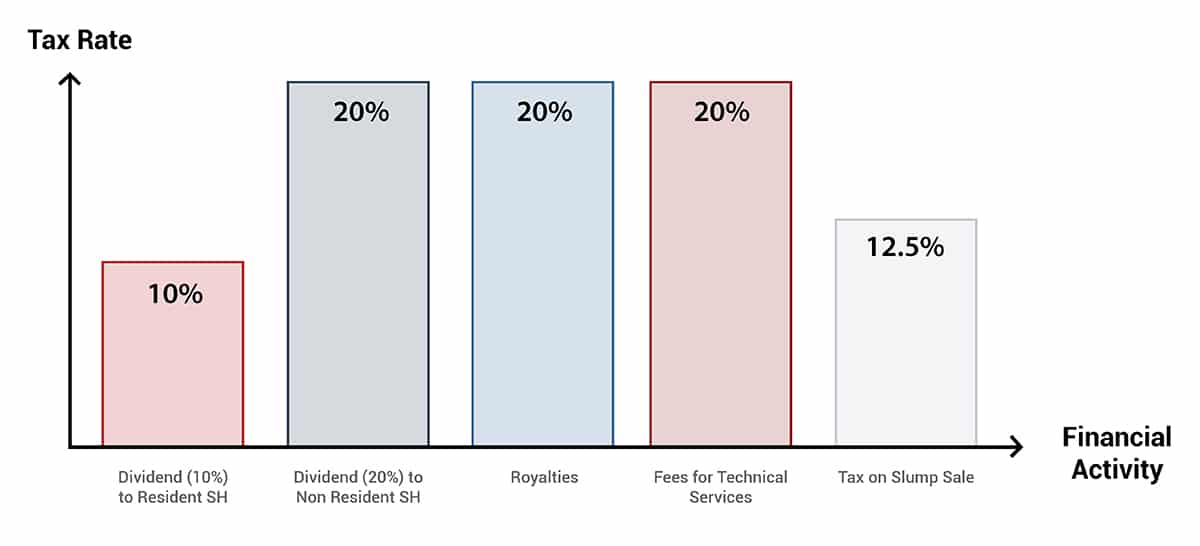

Tax Rates on Repatriation of Funds

|

Particulars |

Tax Rate |

Taxable in the hands of |

| Dividend | 10.00% | Recipient – Resident shareholder |

| Dividend | 20.00% * | Recipient – Non-resident Shareholder |

| Royalties | 20.00% * | Recipient – Non-residents |

| Fees for Technical Services | 20.00% * | Recipient – Non-residents |

| Capital Gains Tax | Different Tax Rate | CG tax will be payable on the gains arising out of the share valuation at the time of winding up/closure of the Company/WoS. |

| Tax on Buyback | Taxed as per the recipient investor’s respective slab rate. | – Income from share buy-back will be treated as taxable as dividend income. |

| Tax on Slump Sale | 12.50% | In case the Business undertaking is held for more than 36 months and transfers its business undertaking for a lump sum consideration, the gains from the Slump Sale will be long-term in nature and the tax rate will be as mentioned alongside. |

*Subject to rates mentioned in the Double Tax Treaty Agreement, whichever benefits the Non-resident individual.

Why Choose India Company Incorporation?

India Company Incorporation is a leading business solutions provider, specialising in helping foreign companies navigate the complexities of setting up and operating a business in India. Our comprehensive approach ensures that your entry into the Indian market is smooth, compliant, and strategically aligned with your business goals. Here’s why you should choose InCorp Global:

Expert Guidance:

Our experienced consultants navigate the complexities of setting up a business in India, ensuring compliance with all regulatory requirements.

Smooth Entry:

We streamline the process, making your business entry into India as seamless as possible.

Growth Support:

InCorp is committed to helping your business grow by identifying and leveraging new opportunities.

Comprehensive Services:

From incorporation to ongoing compliance, we offer a full suite of services to support your business at every stage.

Local Insights:

Our team provides valuable insights into the Indian market, helping you make informed decisions.

For more information, please contact us at info@incorpadvisory.in or (+91) 77380 66622.

Conclusion

Investing in India offers businesses significant opportunities due to the nation’s economic growth, large and young population, government support, low labour cost, and favourable demographics. The government has implemented numerous reforms, such as the Bankruptcy Code, Corporate Tax Cuts, and Relaxed Foreign Ownership rules, to facilitate smoother business operations. With India’s growth potential, it is an excellent addition to any business’s global portfolio.