Public Limited Company Registration

Start your own Public Limited Company in less than 14-20 working days!

Contact us right away!

- 5000+ Businesses Served

- 9.6/10 Unfiltered Customer Ratings

- Satisfaction or Money Back Guarantee

Contact us to know more about our Public Limited Company Registration packages

What is a Public Limited Company?

Public Limited Company is a business entity which offers its shares to the public or whose securities are traded in the stock market. Such companies can raise substantial capital through the issue of shares to the general public. Minimum three Directors, seven shareholders and a registered office are required to incorporate a Public Limited Company in India. In a Public Limited Company, the members have to follow strict compliances as compared to a Private Limited Company. If you want to start a Public Limited Company, then you have landed on the right platform. This piece of information will give comprehensive knowledge about the procedure, eligibility, documents required for Public Limited Company Registration.

Table Of Contents

An Overview

A Public limited company (‘PLC’) enjoys all the advantages of a Private Limited Company and moreover, ability to have an unlimited number of members, ease in transfer of shareholding, and more transparency. Usually, Public Limited Companies get listed with stock exchanges to raise capital from the general public and also provide wide options to raise funds through bank loans, general public, and other fund-raising sources like Institutional investors.

Starting a Public Limited company is a cumbersome process and public limited companies are burdened with multiple regulations of the government. A Public Limited Company can either be an unlisted Company or a listed Company on the Recognized Stock Exchange in India.

Advantages

-

Separate Legal Existence

Company is an artificial person created by law and is different from its members who compose it. It can own property, borrow money, manage bank accounts, employee people on its payroll, enter into contracts, and sue or be sued. -

Perpetual Succession

This means that the membership of a company may keep changing from time to time, but this will not affect the continuity of the business. -

Limited Liability to shareholders

Shareholders are not personally liable for any of the debts of the company, other than for the amount already invested in the company, and for any unpaid amount on the shares in the company, if any. -

Raising funds from multiple avenues

Public companies can easily raise funds from Individuals as well as financial institutions via equity shareholding, preference shareholding, or debentures. Also, a public limited company can issue securities to the general public (IPO/FPO) without any restriction. The funds may be raised via equity shareholding, preference shareholding, or debentures etc after due compliances. -

Other Benefits

- Easy Transferability of Shares

- Growth and expansion opportunities

- Value of the firm is shown by the market capitalisation

- Easy liquidity for shareholders since they can buy and sell their shares

Related read: How To Register A Company In India: A Step By Step Guide

Checklist For Incorporating A Public Limited Company

- A minimum of 3 Directors and a maximum of 50 directors. Of all the directors in the business, at least one must be a resident of India. The directors can only be individuals and not entities like LLPs or Financial Institutions. If the Company is Listed Public Company Minimum 2 Independent Directors is also required.

- A minimum of 7 Shareholders and there is no upper limit on the number of shareholders. At least 1 shareholder should be a resident of India. A director can be a shareholder.

- Minimum Paid-up Share Capital of INR 5 lakhs is required for starting a company.

- The registered office of a company does not have to be a commercial place. Even a rented home can be the registered office, as long as you have the requisite documents.

- Your business must have a unique name that should not match with any existing companies or trademarks in India.

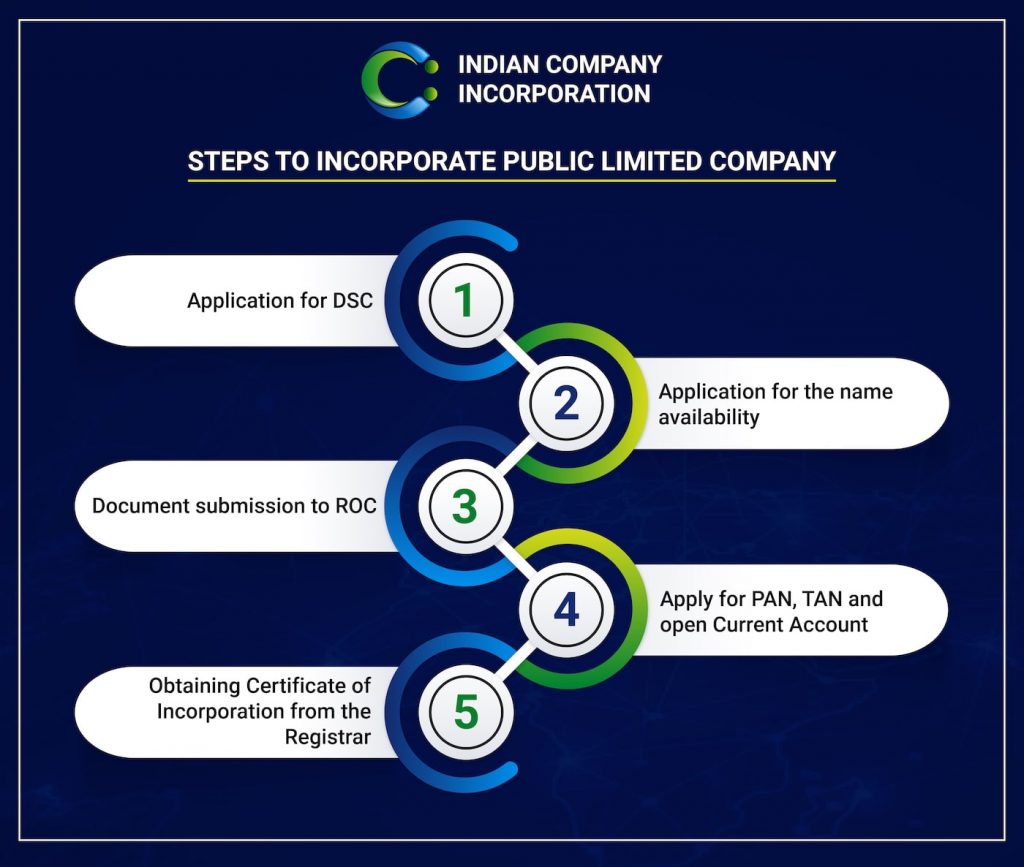

Steps to Incorporate a Public Limited Company

Step 1: Application for DSC (Digital Signature Certificate)

Step 2: Application for the name availability

Step 3: Filing of verified documents along with E-MOA and E-AOA on the MCA portal to register a private limited company in form SPICE + wherein application for various registration as listed below along with the application for Incorporation is done.

| Sr. No | Particulars | Mandatory/ Non Mandatory |

|---|---|---|

| 1. | Director Identification Number | Mandatory |

| 2. | PAN | Mandatory |

| 3. | TAN | Mandatory |

| 4. | Professional Tax Registration | Mandatory |

| 5 | Opening of Bank Account | Mandatory |

| 6 | ESIC | Mandatory |

| 7 | GSTIN | Not Mandatory |

| 8 | EPFO Registration | Mandatory |

Step 4: Obtaining Certificate of Incorporation from the Registrar

Step 5: Depositing the Subscription money in the bank account, and filling of form for Certificate of Commencement.

Requisite Documents

For Directors and Shareholders

Identify the 3 directors (or more) and submit their following mentioned documents:

-

Identity Proof

- PAN (Indian Nationals) or Passport (Foreign nationals) And

- Passport / Driver’s License / Election ID / Ration Card / Aadhar ID -

Proof Of Residence

- Bank Statement / Electricity Bill / Mobile Bill any one (Not later than 2 months) - Passport size photographs

For Registered Office

- Registered document of the title of the premises or notarized copy of lease/rent agreement in the name of the company along with a copy of rent paid receipt not older than one month;

- NOC from landlord to use the premises by the company as its registered office.

- Utility bills like telephone, gas, electricity, etc. showing the address of the premises in the name of the owner, which is not older than two months.

All companies registered in India are required to comply with various rules and regulations. Failure to comply can lead to penalty or disqualification of the directors.

We at ICI will help you in maintaining Statutory compliances for your company at a very affordable price point.

-

1st Board Meeting of the Company Post Incorporation:

The Board of directors must conduct the 1st Board Meeting within 30 days of Incorporation to transact the following:

1. Note the Certificate of Incorporation of the company.

2. Fix the financial year of the Company.

3. Consider the appointment of the first Auditors.

4. Approve preliminary expenses and preliminary contracts.

5. Authorize a Director to maintain books and registers of the company at a registered office.

6. Take a note of the Letterhead of the Company as per Section 12. -

Statutory Auditor Appointment

The board of directors must appoint a practicing Chartered Accountant as their auditor within 30 days of incorporation. -

Commencement of Business

Any company incorporated after November 2018 is mandatorily required to obtain the Commencement of Business Certificate. Hence, post the subscription money is deposited in the bank (Not later than 180 days post Incorporation). The declaration shall be filed within 180 days from the date of getting the Certificate of Incorporation. Share capital mentioned in the MOA [Memorandum of Association] must be deposited in a bank account by the members and commencement certificate must be obtained from MCA. -

Income Tax Filing

The trademark application is then reviewed by the Trademark Registry to confirm if the basic requirements are met, Based on this check, the registry prepares a trademark inspection report. It might take 12-18 months for examination.

Related read:Income Tax Returns (ITR) AY 2021-22: Which ITR Form Should You File?

-

Secretarial Audit

Submission of Secretarial Audit Report along with the Board Report when its total Paid-up capital is equal to or crosses Rs. 50 crore or its annual turnover is equal to or exceeds Rs. 250 crore. -

Annual Return

Companies registered in India must file an annual return each year on or before 31st October. -

DIN KYC

DIN KYC procedure must be completed each year for the directors of the company on or before 30th April. Other than these mandatory compliances, others need to be done depending on the company’s timeline. We at ICI can also assist companies in increasing authorized capital, changing registered offices, change in directors, and others. -

Maintenance of Statutory Registers

Every public company is required to maintain certain Statutory Registers at its registered office in the prescribed form. In case, the company fails to maintain any of the statutory registers, the company, as well as directors, may be fined and prosecuted. -

Board Meetings

Every public company is required to hold a minimum of 4 board meetings (Maximum Gap between 2 Board Meeting cannot be more than 180 days) during the calendar year and an Annual General Meeting at stipulated intervals and also ensure that the minutes of the board meeting are safely retained at the registered office until the company exists. -

Book Keeping

A Public Limited company must maintain proper books of account relating to its affairs each year on a cash or accrual basis. The books of account must be kept as per the double-entry system of accounting at the registered office. -

In addition to this, further registration such as Professional Tax, GSTN, Provident Fund, etc. is required, depending on business type and turnover.

It is important to note that the responsibility of a company to comply with all rules and regulations provided in the Companies Act is a continuous affair and not a one time process.

Incorporating a Public Limited Company at ICI

At ICI, we will help you start your own Public Limited Company in less than 14-20 working days, subject to government processing times, and availability of all documents.

- By following the steps listed below,you can start your own Company,

- Submit a request by clicking here.

- Our Corporate Manager (CM) will get in touch with you to collect your documents along with a simple checklist.

- Submit the filled checklist along-with your documents for verification. Your documents will be verified by our team of experts here at ICI, and we shall take the process further. The CM shall keep you informed throughout the process.

- Once your documents along with the Checklist are submitted and verified, we shall proceed with the application of your DSC & DIN. In parallel to the DSC application, the application for name reservation shall be submitted to the MCA. The name of the Public Limited Company must end with the word “Limited”. This application is filed in the RUN form of the Ministry of Corporate Affairs. It is better to provide a list of names in order of preference, in case a particular name is not available.

- Once the name of the Company has been approved, the crucial documents of the Company – MOA, and AOA have to be executed. We will file the incorporation documents with MCA in part B of a form called “SPICe Plus (SPICe +)” along-with the subscription statement. Usually, MCA approves the forms within 4 - 5 days once filed and issues the Incorporation Certificate with CIN.

- The ROC, after proper verification of all the submitted documents, registers the company and issues a Certificate of Incorporation along with the CIN (Corporate Identification Number) of the Company

- We then begin the process of helping you obtain PAN & TAN for the company and opening a bank account in the name of the company.

FAQs

DIN is allotted by the Central Government to any person intending to be a Director of a company. It is an 8-digit unique identification number that has lifetime validity. DIN is specific to a person, which means even if he is a director in 2 or more companies, he has to obtain only 1 DIN.

Whenever a return, an application, or any information related to a company will be submitted under any law, the director signing such return, application or information will mention his DIN underneath his signature.

When the total capital of a company is divided into shares, it is called as share capital. The share capital is the total amount of capital collected from their shareholders to achieve the objectives of the company.

An address in India where the registered office of the Company will be situated is required. The premises can be a commercial/industrial/residential where communication from the MCA will be received.

No, you will not have to be present at our office or appear at any office for the incorporation of a Limited Company. All the documents can be scanned and sent through email. Some documents will also have to be couriered to our office.

Once a Company is incorporated, it will be active and in-existence as long as the annual compliances are met with regularly. In case, annual compliances are not complied with, the Company will become a Dormant Company and maybe struck off from the register.

Yes, a NRI or Foreign National can be a Director in a Limited Company after obtaining Director Identification Number. However, at least one Director on the Board of Directors must be a Resident India.

| Sr. No | Particulars | Mandatory/ Non Mandatory |

| 1. | Director Identification Number | Mandatory |

| 2. | PAN | Mandatory |

| 3. | TAN | Mandatory |

| 4. | Professional Tax Registration | Mandatory |

| 5 | Opening of Bank Account | Mandatory |

| 6 | ESIC | Mandatory |

| 7 | GSTIN | Not Mandatory |

| 8 | EPFO Registration | Mandatory |

| 9. | Digital Signature Certificate | Mandatory |

Yes, NRIs / Foreign Nationals / Foreign Companies can hold shares of a Limited Company subject to Foreign Direct Investment (FDI) Guidelines.

What Our Clients Say About Us!