E-way Bill

Confused about how to generate your E-way Bills?

Don’t worry we will generate your E-way Bill in no time! Get in touch with us today!

- 5000+ Businesses Served

- 9.6/10 Unfiltered Customer Ratings

- Satisfaction or Money Back Guarantee

Get In Touch With Us To Know More About How We Can Help You With E-Way Bill

What is an E-Way Bill?

An E-way bill is a receipt or document generated on the e-way bill portal by either the consignor or consignee that provides details and instructions for transporting a consignment of goods, including the name of the shipper, the recipient, the origin of the recipient, and their destination.

It is a compliance mechanism and the person (including seller/buyer/transporter) who causes the movement of goods uploads the relevant information through the digital interface and creates the E-Way bill on the GST portal before the transportation begins.

On the generation of an E-Way bill, a unique E-Way Bill Number (EBN) is generated which is made available to the supplier, recipient, and the transporter.

Table Of Contents

Related Read: An Overview On GST And 5 Ways GST Impacts Your Business

When To Generate An E-way Bill?

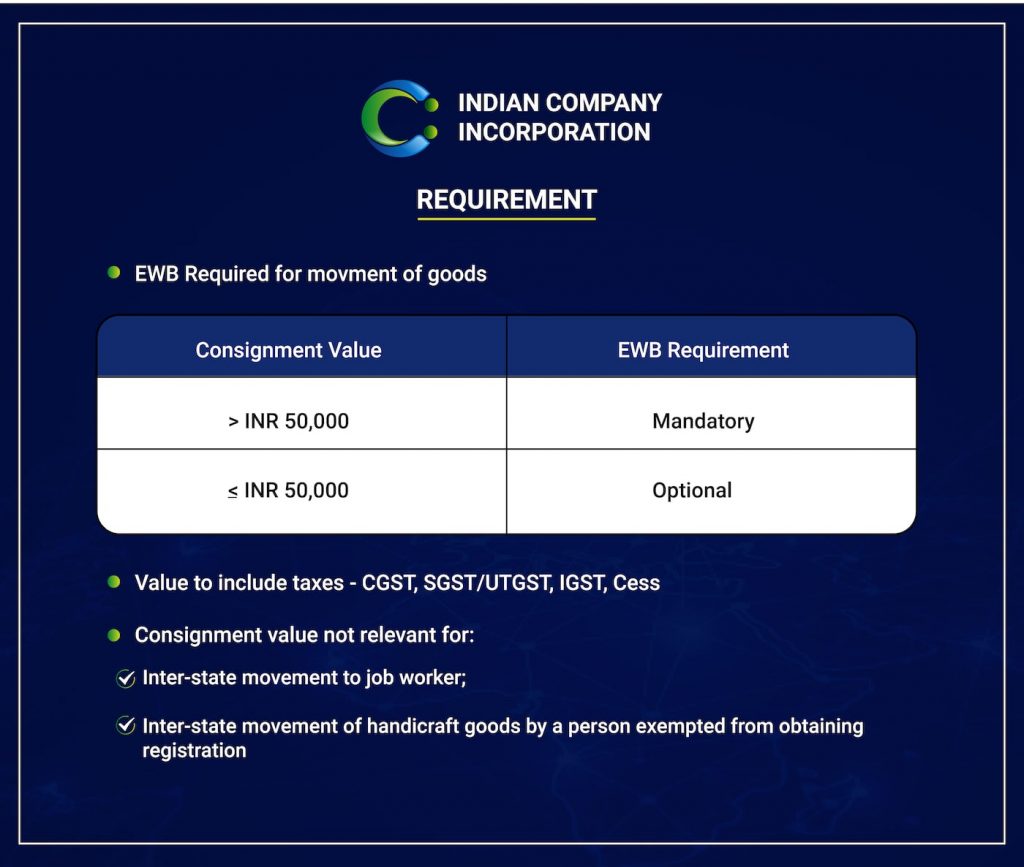

- A registered person causing the movement of goods of consignment value exceeding Rs 50,000 needs to generate an E-way bill when-

- He undertakes any supply of good under GST (including returns) or

- He moves goods from one godown to another or

- He undertakes moment of goods for reasons other than supply

- He purchases under GST any goods from an unregistered person

- *Consignment Value of Rs. 50,000 includes GST amount

- A special situation where you need to issue an e-way invoice even if the shipment amount is less than Rs. 50,000:

- Inter-State transfer of goods by principal to job-workers.

- Inter-State transfer of handicraft goods by persons exempt from registration.

Who Should Generate An E-Way Bill?

Cases when an E-Way bill is not required ?

- Goods transported are as specified in the below annexure.

- The mode of transport is a non-motor vehicle

- Empty Cargo containers are being transported

- The goods are being transported from the port, airport, air cargo complex and land customs station to an inland container depot or a container freight station for clearance by Customs

- The goods being transported are alcoholic liquor for human consumption, petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas or aviation turbine fuel

- Transportation of exempted or non-taxable goods

| Description of Goods | |

|---|---|

| 1 | Liquefied petroleum gas for supply to household and non domestic exempted category (NDEC) customers |

| 2 | Kerosene oil sold under PDS |

| 3 | Postal baggage transported by Department of Posts |

| 4 | Natural or cultured pearls and precious or semi-precious stones; precious metals and metals clad with precious metal (under HSN Chapter 71) |

| 5 | Jewellery, goldsmiths’ and silversmiths’ wares and other articles ( under HSN Chapter 71) |

| 6 | Foreign Currency |

| 7 | Used personal and household effects |

| 8 | Coral, unworked (HSN 0508) and worked coral (HSN 9601) |

Calculate HSN & SAC Code using our free tool!

Validity Of an E-Way Bill

Validity of an E-Way bill is listed below. Validity is based on the distance travelled by the vehicle containing the consignment of goods. Validity starts from the date and time of the generation of E-Way bill-

| Type of conveyance | Distance | Validity of E-way Bill |

|---|---|---|

| Other than Over dimensional cargo | Upto 100 Kms | 1 Day |

| For every additional 100 Kms or part thereof | Additional 1 Day | |

| For Over dimensional cargo | Upto 20 Kms | 1 Day |

| For every additional 20 Kms or part thereof | Additional 1 Day |

Extension of E-Way bill is possible only if done before or after 4 hours of expiry

Documents required

- Invoice/ Bill of Supply/ Challan related to the consignment of goods

- If goods transported by road – Transporter ID or Vehicle number

- If goods transported by rail, air, or ship – Transporter ID, Transport document number, and date of the document

How can we help you ?

- Generating E-Way bills.

- Training your staff on generation of E-Way bills.

- Consultancy on applicability and non- applicability of E-Way bills in case of special cases or notified businesses.

FAQs

It is used to monitor the movement of goods, to check tax evasion. As a general rule, route calculation is required along with goods on the way from sender to receiver. According to GST, e-way invoices are subject to a uniform set of rules throughout the country.

If the supplier is registered and promises to ship the goods, the goods movement will be triggered by the supplier. The movement is triggered by the recipient when he arranges the shipment. If the goods are delivered from an unregistered supplier to a registered and known recipient, the transfer is considered to be due to that recipient.

» Click the Print EWB sub-option on the E-Way invoice tab.

» A screen is displayed that allows the user to recall and print the relevant E-Way invoice.

» Enter your 12-digit E-Way invoice number. About the E-Way invoices that need to be printed.

» Select “Go”

» Indicates that the associated E-Way invoice will be displayed at the bottom with the Print option. Click to print the e-way invoice.

Yes, the E-Way Bill can be cancelled within 24 hours of its generation.

If you are not registered, you will also need to create an e-way invoice. However, in case of delivery from an unregistered person to registered person, then the registered person must ensure that all conformance is met, as if he were a supplier.

E-Way bill can be generated by an unregistered person by enrolling itself on the E-Way bill system.

If multiple shipments are shipped in a single shipment after the e-way invoice has been created in accordance with sub-rule (1), the carrier will in each case create an e-way invoice serial number that can show the number. An integrated e-way invoice for the common portal and FORM GST EWB-02 will be created by him at the common portal prior to product traffic.

TRANSIN or Transporter ID is a 15 digit unique number generated by the EWB system for unregistered transporters, once he enrolls in the system which is similar to GSTIN format and is based on state code, PAN, and a Checksum digit. This TRANSIN or Transporter id can be shared by the transporter with his clients who may enter this number while generating e-waybills for assigning goods to him for transportation.

Speak to our experts who shall solve all your doubts.

Call us at +91 7738 066 334 or Mail us at info@indiacompanyincorporation.com

What Our Clients Say About Us!